Commentary – Platinum plans evidenced the greatest improvement in

average deductible amounts compared to 2014. The average individual and family

deductibles are 30% lower than the averages documented for 2014.11 In

contrast, the annual cap on out-of-pocket costs for covered medical services

delivered in-network increased by 6% for both individuals and families in

2015.12

The average cost of doctor visits was up 13% to $18 in 2015 while specialist

visits declined 3% to $29.

Conclusion

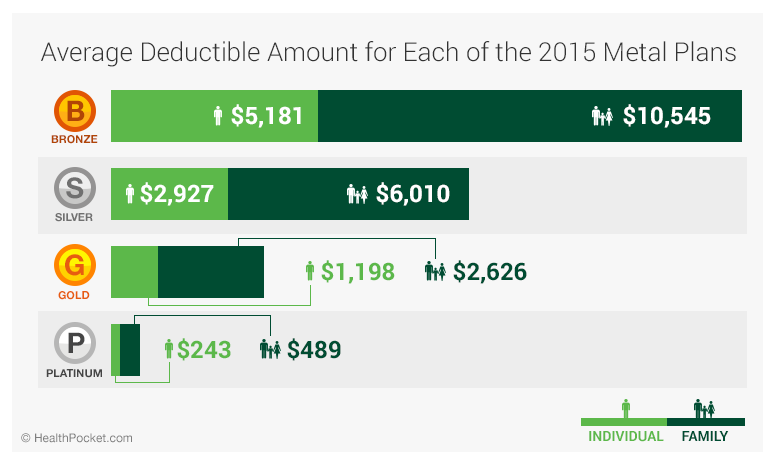

2015 marks another year where unsubsidized deductibles average over $1,000

for three of the four Affordable Care Act plan types. Gold and Platinum plans

evidenced deductible improvements as compared to 2014 while bronze and silver

plans were slightly higher.

Consumers should make note that deductible averages characterize a range of

deductible amounts from lower to higher. Accordingly, for those consumers who

expect to use healthcare moderately to frequently, careful attention should be

paid to health plan cost-sharing before enrollment. In many cases, out-of-pocket

copayment and coinsurance fees for physician visits apply after a

deductible amount has been satisfied, meaning that the consumer would pay the

full cost of the visit during the deductible period.

Those consumers making 250% or less of the 2014 Federal Poverty Level are

eligible for cost-sharing subsidies that reduce deductibles, co-payments, and

coinsurance fees.13 These cost-sharing reductions are only available

on silver plans for those who qualify.14

Healthier consumers who expect to use healthcare infrequently should focus

less on cost-sharing and more on premium expense and the quality of in-network

healthcare providers in the event that a serious medical condition occurs.

METHODOLOGY

Out-of-pocket costs for 2015 Affordable Care Act health plans was based on

multiple Qualified Health Plan (QHP) Landscape files for government marketplaces

(2015_QHP_Landscape_Individual_Market_Medical,

2015_QHP_Landscape_NM_Individual_Market_Medical,

2015_QHP_Landscape_NV_Individual_Market_Medical, and

2015_QHP_Landscape_OR_Individual_Market_Medical). Bronze, silver, gold, and

platinum health plan data was used, covering multiple rating regions within the

states included in the landscape file. Catastrophic plans, while Affordable Care

Act health plans, were not included within the scope of this study due to their

special eligibility requirements. Premiums do not include any applicable

government subsidies. The QHP Landscape files were downloaded by HealthPocket

from the Centers for Medicare & Medicaid Services November 14, 2014.

All plans investigated in this study belong to the individual & family

insurance market. Medicare, Medicaid, short-term health insurance, and group

health insurance plans were not analyzed as part of this study.

Industry standard rounding methods were utilized.

No weighting by health plan enrollment was performed.

AUTHOR

This preview was written by Kev Coleman, Head of Research & Data at

HealthPocket. Correspondence regarding this data can be directed to Mr. Coleman

at kevin.coleman@healthpocket.com.

Kev

Coleman on Google+

Sources:

1 In calendar year 2014, a high deductible health

plan was defined as ga health plan with an annual deductible that is not less

than $1,250 for self-only coverage or $2,500 for family coverage.h http://www.irs.gov/pub/irs-drop/rp-13-25.pdf In 2014, the

average deductible for 2014 bronze plans was $5,081 individual/$10,386 family,

the average deductible for 2014 silver plans was $2,907 individual/$6,078

family, and the average deductible for 2014 gold plans was $1,277

individual/$2,846 family. Kev Coleman and Jesse Geneson. gDeductibles,

Out-Of-Pocket Costs, and the Affordable Care Act.h HealthPocket.com (December

12, 2013). http://www.healthpocket.com/healthcare-research/infostat/2014-obamacare-deductible-out-of-pocket-costs

2

While a 2014 high deductible health plan must have a deductible at least $1,250

for an individual and $2,500 for a family, the average deductible for platinum

plans in 2014 was $347 individual/$698 family. Coleman, Geneson. gDeductibles,

Out-Of-Pocket Costs, and the Affordable Care Act.h

3 Robert Pear.

gOn Health Exchanges, Premiums May Be Low, but Other Costs Can Be Highh New York

Times. (December 9, 2013). http://www.nytimes.com/2013/12/09/us/on-health-exchanges-premiums-may-be-low-but-other-costs-can-be-high.html.

Last accessed November 19, 2014.

4 See online broker eHealthfs

statistics on their off-exchange sales. gHealth Insurance Price Index Report for

Open Enrollment and Q1 2014h eHealth. (May, 2014). p.4. https://www.ehealthinsurance.com/resource-center/wp-content/themes/ehi_rc/price-index/data/quarterly-index.pdf.

Last accessed November 19, 2014.

5 Coleman, Geneson. gDeductibles,

Out-Of-Pocket Costs, and the Affordable Care Act.h

6 Kaiser Family

Foundation and Health Research & Education Trust. gEmployer Health Benefits

- 2014 Annual Survey.h Kaiser Family Foundation. (September 10, 2014). p.125. http://files.kff.org/attachment/2014-employer-health-benefits-survey-full-report.

Last accessed November 19, 2014.

7 As compared to copayments or no

cost-sharing. Instances where copayments were used in stage of coverage (e.g.

deductible period) and coinsurance fees were used in a different period of

coverage (e.g. post-deducible) were excluded though they were not more common

than coinsurance fees alone with respect to bronze plans.

8 A

post-annual enrollment period report for the 2014 plan year reported that g65

percent of the persons who have selected a Marketplace plan have selected a

Silver plan.h gHEALTH INSURANCE MARKETPLACE: SUMMARY ENROLLMENT REPORT FOR THE

INITIAL ANNUAL OPEN ENROLLMENT PERIOD.h Department of Health and Human Services.

(May 1, 2014). http://aspe.hhs.gov/health/reports/2014/marketplaceenrollment/apr2014/ib_2014apr_enrollment.pdf

Last accessed November 19, 2014.

9 http://www.irs.gov/pub/irs-drop/rp-14-30.pdf

10

The minimum family deductible amount to qualify as a high deductible plan is

$2,600 in 2015. http://www.irs.gov/pub/irs-drop/rp-14-30.pdf

11

See Coleman, Geneson. gDeductibles, Out-Of-Pocket Costs, and the Affordable Care

Act.h

12 The annual cap on out-of-pocket costs for platinum plans

in 2014 was $1,971 for individuals and $3,942 for families. See Coleman,

Geneson. gDeductibles, Out-Of-Pocket Costs, and the Affordable Care

Act.h

13 https://www.healthcare.gov/lower-costs/save-on-out-of-pocket-costs/

14

Ibid.